2021-04-20

HWGG Capital and GEA Limited Expands Remittance Internationally

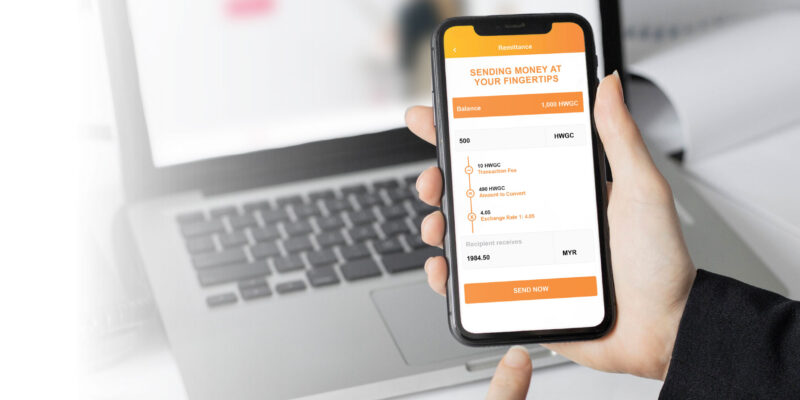

HWGG Capital P.L.C. (“HWGG Capital”) announced its partnership with Global E-money Alliance (“GEA”), a leading global social banking platform and fastest growing financial services provider based in Hong Kong. This partnership enables an integration of GEA’s worldwide e-money remittance solution into HWG CASH’s blockchain ecosystem. It allows instant and secure fund transfer using digital assets such as HWG CASH and Tether (USDT) to any designated foreign bank accounts as an international remittance.

Launched in 2019, GEA is an integrated global social banking platform for consumer-centric financial institutions to deliver frictionless interoperable payments, instant messaging and fund transfer across 160 countries.

Through the partnership, HWGG Capital will be extending its global money transfer service through GEA’s readily available global footprint network of 8 countries and more than 100,000 money transfer locations. For example, a receiver in the Philippines can now receive the money at a bank account remitted internationally from a digital asset user using HWGCash App.

“We are very excited with this partnership as it brings greater value to our ecosystem by enabling a new transaction channel of sending remittance with digital assets,” said Mavis Mok, Chief Executive Officer of HWGG Capital. “This collaboration allows our HWGCash App’s users to perform remittance service with no minimum transaction amount at a fixed handling fee to all the supported countries and currencies” added Mok.

Licensed under the Labuan Financial Services Authority (LFSA), the HWGCash App serves as a medium connecting both digital and traditional markets, where traditional companies can offer their products and services to digital asset users, which can later be processed into fiat currency for settlement.

Recently, the latest addition of AMPLIFY to HWGCash App provides instant investment with digital assets to other financial instruments such as Growth & Property Funds, making it as Asia’s first fully licensed digital asset payment services platform to host finance products from investment banks or financial institutions.